Renters Insurance in and around Edmond

Looking for renters insurance in Edmond?

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

Home Sweet Home Starts With State Farm

There's a lot to think about when it comes to renting a home - price, furnishings, parking options, apartment or townhome? And on top of all that, insurance. State Farm can help you make insurance decisions easy.

Looking for renters insurance in Edmond?

Rent wisely with insurance from State Farm

Open The Door To Renters Insurance With State Farm

When the unexpected break-in happens to your rented space or townhome, often it affects your personal belongings, such as a desk, a stereo or a cooking set. That's where your renters insurance comes in. State Farm agent Blake Jordan wants to help you choose the right policy so that you can keep your things safe.

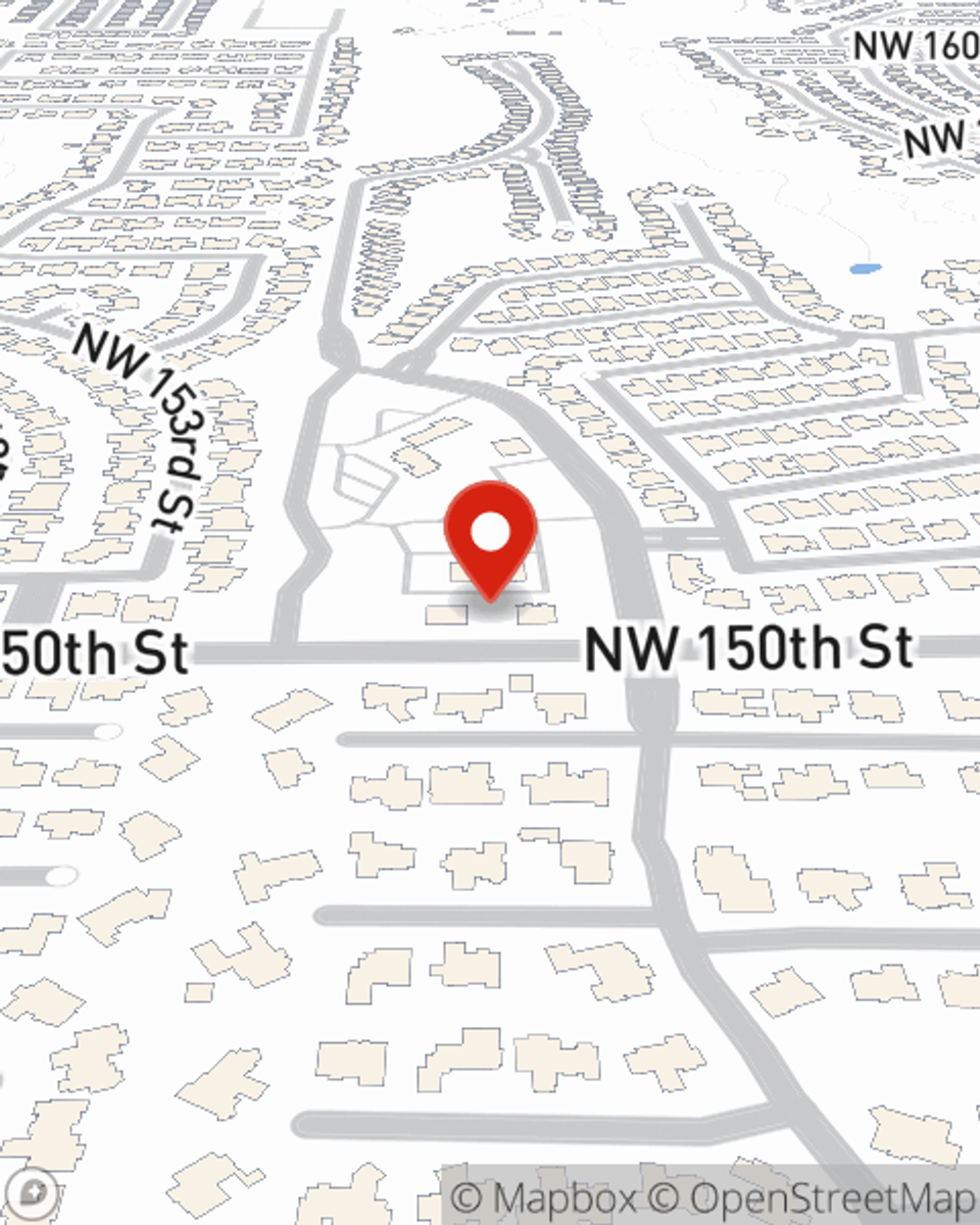

Renters of Edmond, State Farm is here for all your insurance needs. Visit agent Blake Jordan's office to learn more about choosing the right policy for your rented space.

Have More Questions About Renters Insurance?

Call Blake at (405) 471-5370 or visit our FAQ page.

Simple Insights®

How to file a renters insurance claim

How to file a renters insurance claim

Learn how to file a renters insurance claim and understand your renters insurance coverage.

Does renters insurance cover hotel stay?

Does renters insurance cover hotel stay?

Renters insurance may offer support for hotel stays and temporary housing costs when your rented home becomes unhabitable due to a covered claim.

Blake Jordan

State Farm® Insurance AgentSimple Insights®

How to file a renters insurance claim

How to file a renters insurance claim

Learn how to file a renters insurance claim and understand your renters insurance coverage.

Does renters insurance cover hotel stay?

Does renters insurance cover hotel stay?

Renters insurance may offer support for hotel stays and temporary housing costs when your rented home becomes unhabitable due to a covered claim.